Receipt For Tax Deductible Donations

Cash donations of up to 300 made this year by December 31 2020 are now deductible without having to pay taxes on them in 2021. A donor gives a charity a house valued at 100000.

An Outline Of Donation Receipts And The Tax Deduction Process Cascade Business News

Oftentimes donation receipt templates will include these lines at the bottom.

. Description but not value of non-cash contribution. Yes you may still qualify for the charitable donations tax deduction without the charitable donation receipt. Your organization can use donation receipts to aid in your accounting processes and to track a donors history with your organization.

You do not need. To receive the tax deductions associated with charitable giving donors need documentation. Join 100000 Causes accepting donations online using Give.

Ad Download Or Email ACS Forms More Fillable Forms Register and Subscribe Now. Political party and independent candidate donations. To claim contributions of more than 10 you need a receipt.

Generally property contributions are not included in this list. The first and probably most well-known reason for issuing donation receipts is that donations are by US. Property we value at more than 5000.

Typically an organization must give you a written statement if you donate more than 75. For a tax-deductible donation receipt to count as. For single contributions of 250 or more donors need a written acknowledgment such as a donation receipt to claim tax returns.

Sample 4 Non-cash gift with advantage. Amount of cash contribution. The key distinction to make is that without an official written acknowledgment donors cant claim a tax deduction for their donation.

Charitable Contributions - Written Acknowledgments. Tax deduction is given for donations made in the preceding year. Up to 4 cash back For non-cash donations of all amounts youll need to have a receipt to take the deduction.

Claiming Tax Deductible Donations. Donors use them as a confirmation that their gift was received and for charitable giving deductions when tax season rolls around. As a quick recap the amount of an individuals total donations over the course.

Deductions on Tax Returns. Ad Easily Create Donation Pages Using a Powerful Fundraising Plugin. The written acknowledgment required to substantiate a charitable contribution of 250 or more must contain the following information.

What is a Donation ReceiptTax Receipt. This will help the donors to be eligible to claim for the donation deduction when it comes to taxable income. The charity gives the donor 20000 in return.

Shares valued at 5000 or less. Ad Download Or Email ACS Forms More Fillable Forms Register and Subscribe Now. Nonprofit donation receipts serve both donors and your nonprofit.

This includes a wide range of gifts including cash stock legal advice or in-kind. So instead of just thanking them you can do more especially for those that gifted above 250 for tax deductions. So the eligible amount of.

Cash gifts of less than 250 are valid for donation deduction without a receipt. It serves as proof that the donor has made a donation to a charitable organization and can be used to receive a tax-deduction by the IRS. The amount of the advantage 20000 must be subtracted from the amount of the gift the 100000 value of the house.

Fill Edit Sign Forms. If the vehicles value is between 250 and 500 you can use a standard donation receipt. You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions.

Out-of-pocket expenses when donating your services. Generally you may deduct up to 50 percent of your adjusted gross income but 20 percent and 30 percent limitations apply in some cases. Donors Use Donation Receipts for Tax Deductions.

If you made donations of 2 or more to bucket collections for example to collections conducted by an approved organisation for natural disaster victims you can claim a tax deduction for gifts up to 10 without a receipt. Name of the organization. You can obtain these publications free of charge by calling 800-829-3676.

How do donation receipts work for donated vehicles. Look Professional - Make a good impression with this clear and intuitive invoice. This letter will help you to acknowledge the receipts of gifts and donations from the donors in a very simple way.

For example if an individual makes a donation in 2021 tax deduction will be allowed in his tax assessment for the Year of Assessment YA 2022. Select a Premium Plan Get Unlimited Access to US Legal Forms. Because charitable donations are tax-deductible for the donor and reportable by the nonprofit organization a donation receipt must include specific information about the value of the donation and what the donor received in return.

Donations receipts are used as a tax deduction on the donors federal tax return and are required for amounts over 250. Is it a gift or contribution. Gift types requirements and valuation rules.

A donation receipt is the first step toward showing your donor appreciation for what theyve done for your organization. Donating recently purchased property to a DGR. To claim an endowment deduction without a receipt a donor must provide a bank record or a payroll-deduction record to.

Gift types and conditions. Simplify your payment process with KeelaPay. Donating under the.

Ad Free Invoice Template for small businesses designed to increase sales. The type of donation records which may include a donation receipt letter will depend upon the amount of your contributions and whether they are. Statement that no goods or services were provided.

A Donation Receipt sometimes called a tax receipt is a formal written statement from a qualifying nonprofit which acknowledges they received a donors donation. Gifts of 2 or more. The donation receipt is created for tax purposes while the thank you letter acknowledges the donors.

Avoid putting a line on your tax receipt that indicates the gift will be tax-deductible.

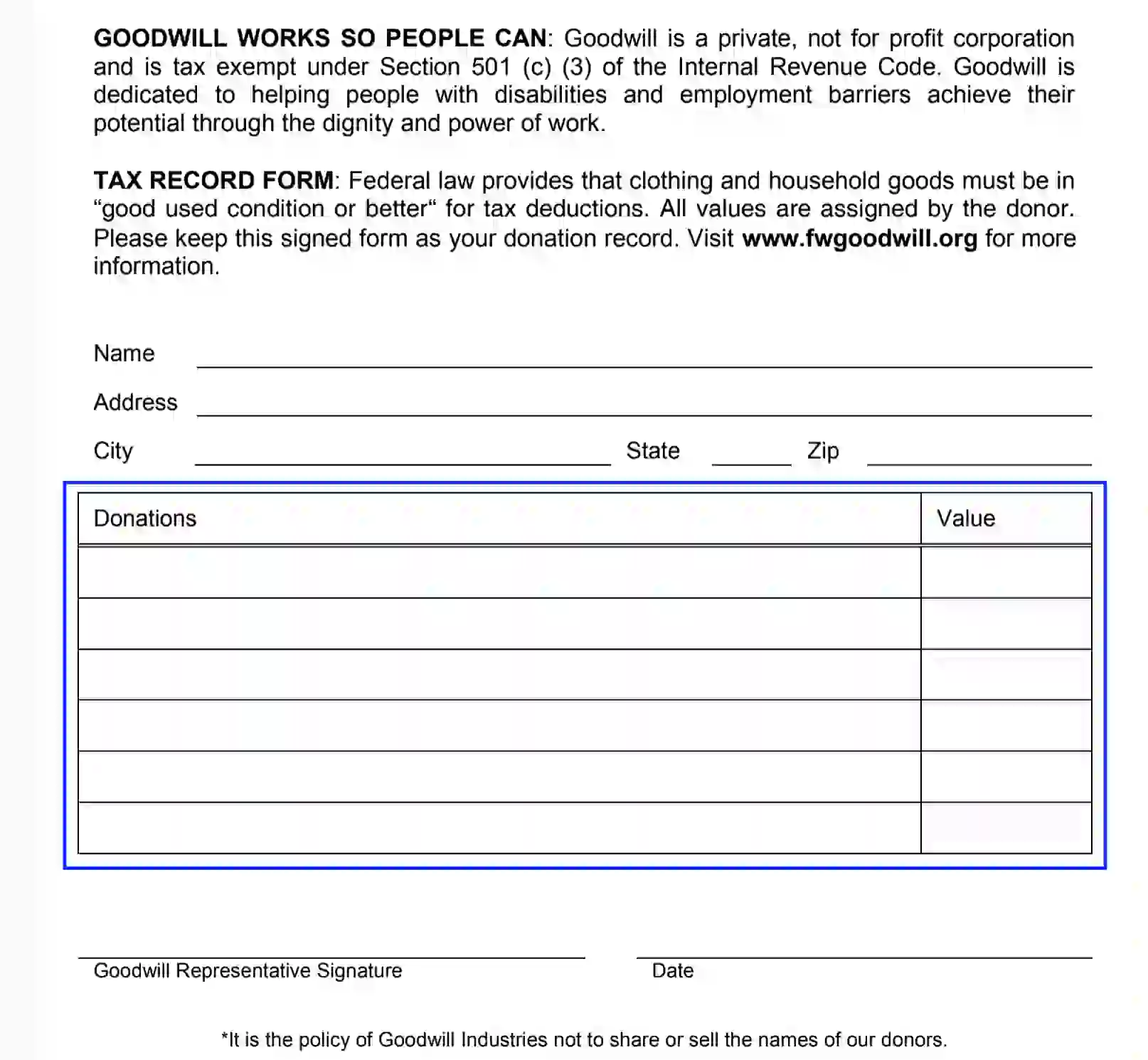

Free Goodwill Donation Receipt Template Pdf Eforms

Goodwill Donation Receipt Fill Out Printable Pdf Forms Online

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

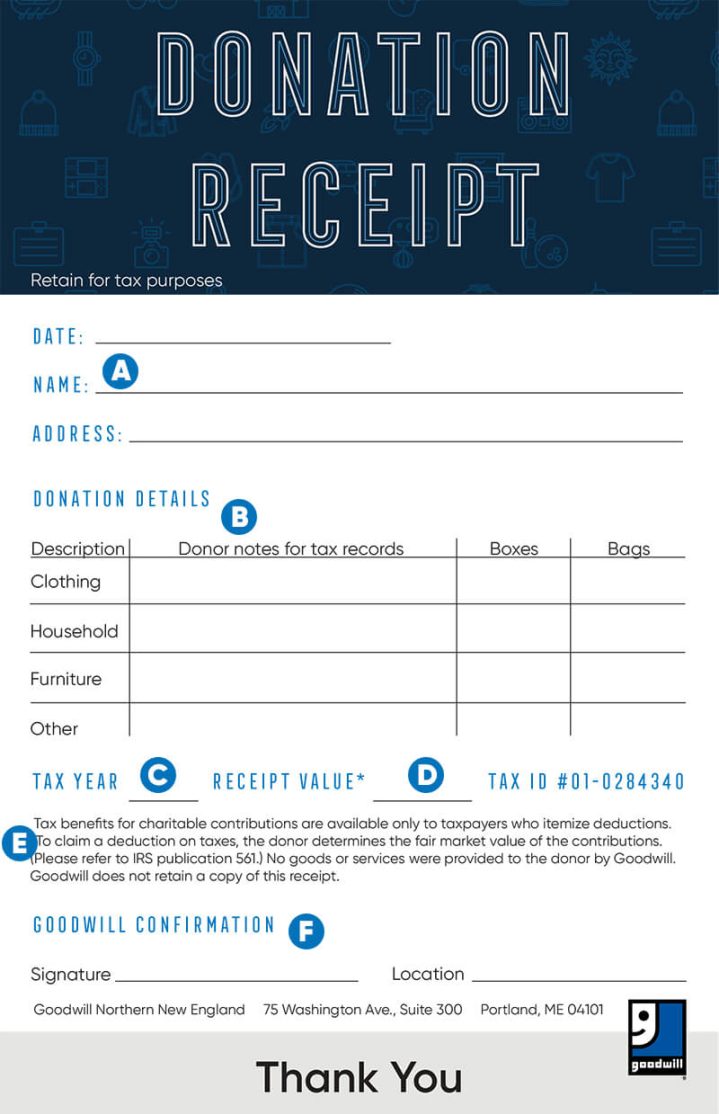

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

Tax Receipt Sweet Cheeks Diaper Bank

Tax Deductible Donation Receipt Template Using The Donation Receipt Template And Its Uses Donation Rece Receipt Template Letter Template Word Donation Form

How To Fill Out A Goodwill Donation Tax Receipt Goodwill Nne

Four Steps To Making Your Charitable Donation Eligible For A Deduction The Scarletredish Rack

Donation Receipts Statements A Nonprofit Guide Including Templates

Comments

Post a Comment